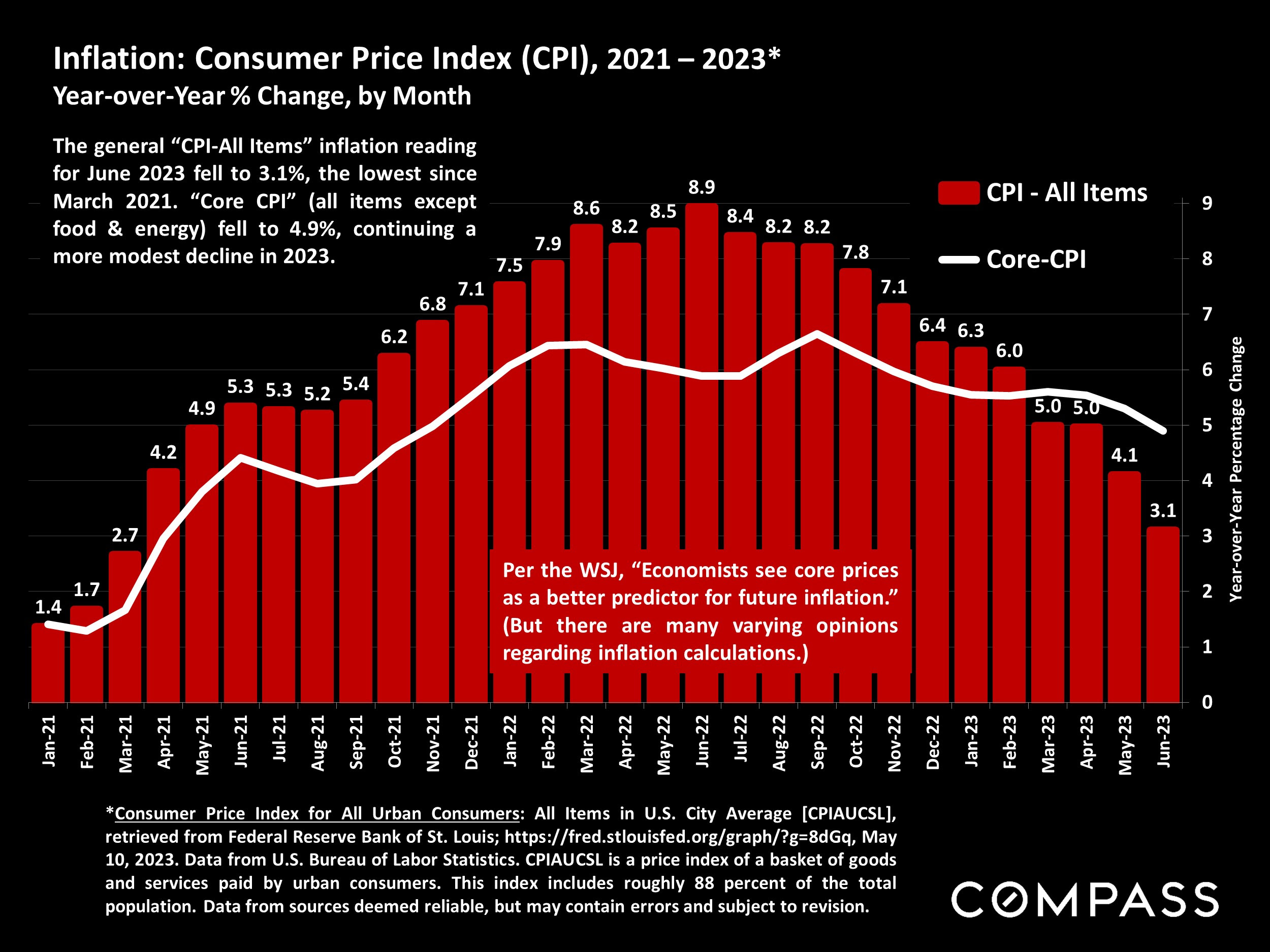

The battle against inflation is being won, and the bay area housing market seems to have mostly rebounded.

The producer price index (PPI) is lagging the consumer price index (CPI), which suggests that the economy is in a different place than most people think. This could mean that the economy is not headed for a recession.

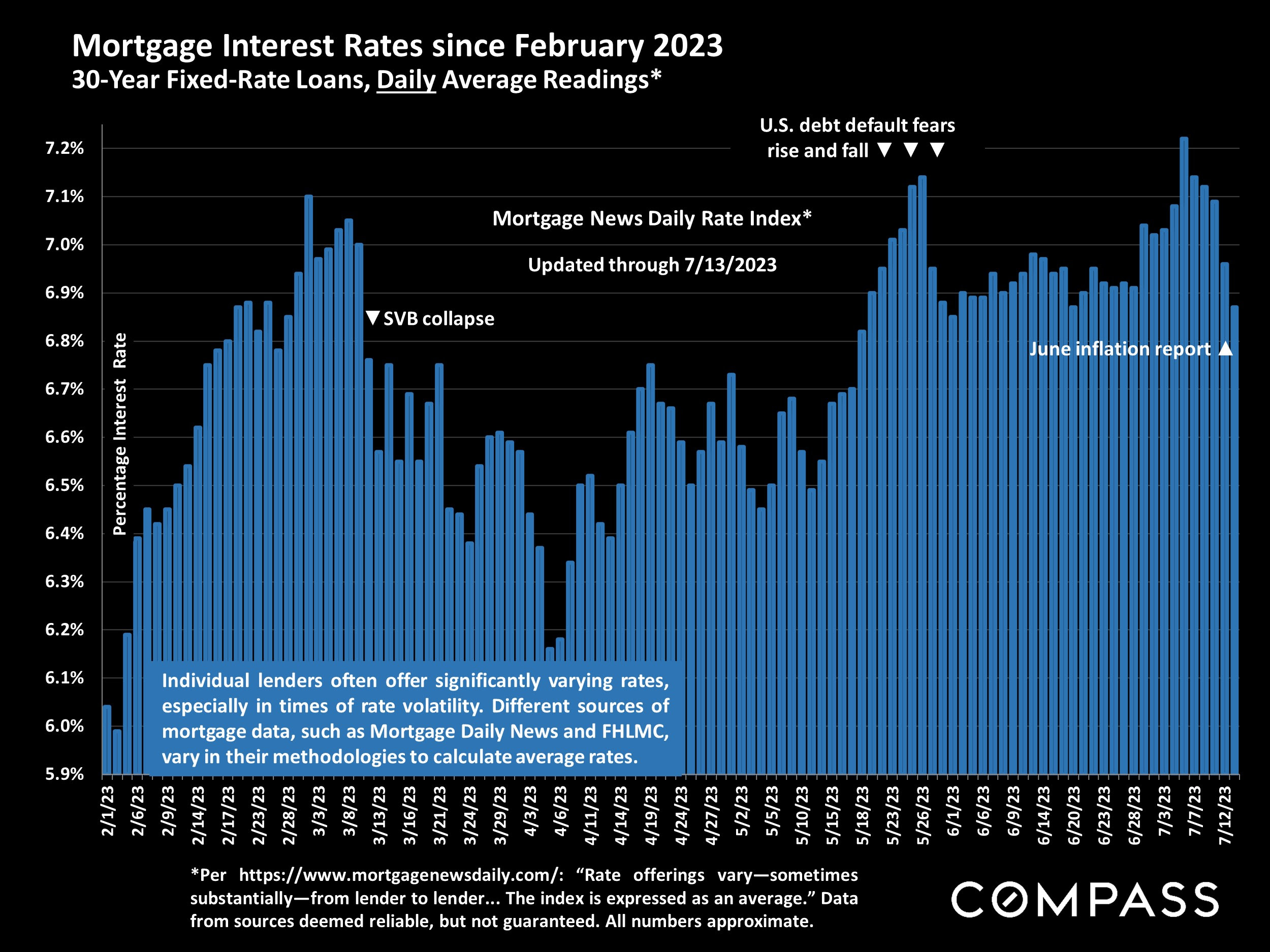

The market signals are mixed. On the one hand, two-year bonds have yielded more than 5%, which is a sign that the Fed may be on hold for a while. On the other hand, the fed funds rate predicted for the December meeting of the Federal Open Market Committee has barely moved recently. This suggests that the Fed is still worried about inflation, and that it may not be done raising rates yet. Mortgage rates, however, have generally been holding steady with a recent trend lower after the newest inflation data.

The Bay Area real estate market typically tracks the technology heavy Nasdaq index. As the Bay Area is home to many large technology companies, the stock market performance of these companies has a big impact on the local economy.

Traditionally, Bay Area real estate has been driven by local employees at these companies. In the first half of 2023, option incentives for local employees at major tech companies have risen significantly compared to the latter half of 2022.

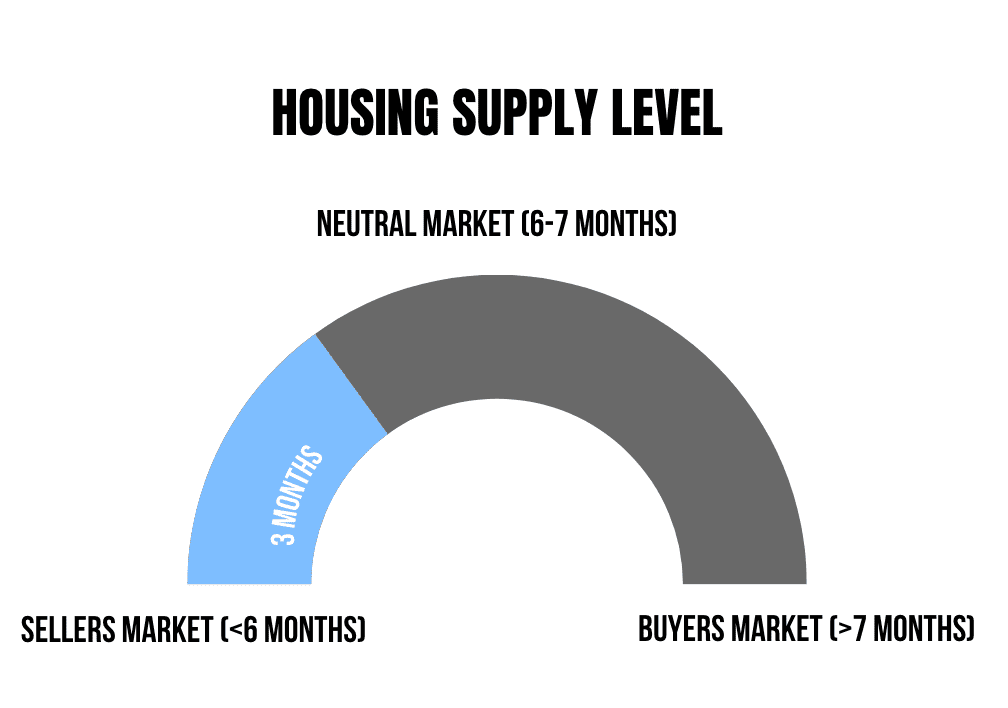

This, combined with extremely low housing inventory in neighborhoods with good schools and family-oriented neighborhoods, has led to multiple offers on turnkey-ready homes. This is why our team offers renovation services to help homeowners get the highest price for their homes. Most buyers are looking for move-in ready properties, so our renovations can help sellers make their homes more attractive to buyers.

In Case You Missed It

- Proposition 19 Tax Savings Calculator – Prop 19 Calculator – KeiRealty

- Market Update for H1 2023 – Market Update for H1 2023 – KeiRealty

- How Reliable are Online Estimates? – Zestimate or Zestimiss? Is Zillow Damaging your Home Value? – KeiRealty

- What Happens to Your Property taxes after Renovation? – You’ve Just Remodeled Your Home. What Happens to Your Property Taxes? – KeiRealty

- California’s recently passed SB9 and SB10’s affect on Single Family Zoning – How SB 9 Will End Single-Family Zoning in California – KeiRealty

- President Biden’s proposed tax plan and how it may affect real estate – Biden’s Tax Plan – KeiRealty

- Why you may want to rent out your home before selling – Capital Gains and 1031 Exchange by keirealty

- Breakdown of Proposition 19’s affect on California real estate – Moving Homes? Here’s What You Need to Know About Prop. 19 in California – KeiRealty